Intro to Finance Management: Free Online Course

Build your MBA talent stack in finance.

Welcome to the Finance MBA Stack. This free online course in Finance Management will direct students to articles, videos, and podcasts related to the Finance industry. There are two to three hours of material centrally focused on building a solid finance stack within each section. The student will learn more concise information and resources related to the public, private, and voluntary sectors.

In this Finance Stack, there are five areas of focus. They are labeled as The World of Finance, Foundations of Finance, Changes in Finance, Opportunities in Finance, and The Finance Talent Stack. At the end of each section, the student will have an opportunity to invest in their learning. Other than the investment opportunity, this is a free course with some free resources included—what a great chance to learn more about an area you are passionate about.

We want you to take advantage of this opportunity, make notes and analyze your talent toolbox. Where are you lacking? What are your strengths in this area? What innovative ideas do you think you can bring to the field? What is your USP (Unique Selling Proposition)? Use this as a baseline as you consider your future in the lucrative world of finance. Some professionals should even consider more formal educational avenues, like an MBA. Remember that nothing is more expensive than a missed opportunity! Here’s the opportunity; now, let’s prepare for your success!

The World of Finance Management

When we think of finance, we visualize the woman behind the desk with ledges stacked to the ceiling, and she is crunching numbers with a calculator with receipt tape overflowing the desk. But there are so many facets within the world of finance.

So when did it all begin? Who had the first calculator?

When we think of the vast world of finance, we are taken back across the pond to England and Europe, where many financial ideals and principles were invented. As we continued to research the origins, we learned that many countries and sub-groups had their economic systems implemented.

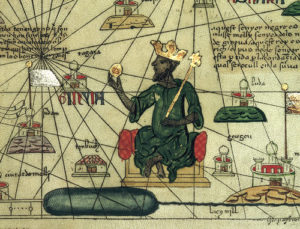

In 2000 BC, grain loans were given to farmers and traders in India. In the Ancient Greek and Roman Empires, lenders were based in temples giving out loans and taking deposits. We are also taken back to Napoli, Italy, where the idea of modern banking was founded. Africa produced the largest amount of gold, and Mansa Musa was the wealthiest man globally, making the Mali Empire a huge finance mecca.

Listen to this podcast on Mansa Musa. In what ways did his financial prowess affect the building of communities around him and even his country?

From the dawn of time, finance has been a staple in every country. Some countries approached it differently, but it is historically noted. I am taken back to a moment in William Shakespeare’s The Merchant of Venice. In the play, an essential lesson on finance is taught by the character Shylock. Shylock was a named moneylender, and Antonio took out a loan that he couldn’t repay. As stated in the promissory note, if Antonio could not repay the loan, Shylock requested a pound of his flesh.

Thankfully, times have evolved, and we do not demand flesh upon default of a loan; we are reminded of how imperative the finance world is to us personally and for those who look to make a career in the industry. By embarking on this journey in finance, you will have the opportunity to see how money makes the world go round!

The Palgrave Macmillian website has many free resources centered on the origins of finance. Check out one of the pieces that pique your interest. Maybe try the Early History of Bond Finance or the piece on Early US Financial Markets. Remember that understanding our past helps us better understand our present. Are there any moments in finance history that relate to what you see in our current situation?

Careers in Finance

The one-million-dollar question is, what can I do with a finance degree, like a Finance MBA? Is this a lucrative career? Here’s a panel from the University of Houston Clear Lake Career Services focusing on jobs in finance.

As they say, there are levels to the game, and we found three areas within the finance world where you can work. These sectors detail the type of organization you would work for and will give you an understanding of how you would work within their financial departments. Those sectors are the private sector, the public sector, and the voluntary sector. While sounding the same, they are very different, and the roles and responsibilities within each arm are different.

What is the Private Sector?

A private sector is a group run by people/ companies that are for-profit and not state-controlled. This includes all business entities that are not owned or operated by the government. Types of private sector businesses include:

- Sole proprietorships.

- Partnerships.

- Small and mid-sized companies.

- Large corporations and multinationals.

- Professional and trade associations.

- Trade unions.

Some of the top five private sector companies include Cargill, Koch Industries, Albertsons, Deloitte, and Pricewaterhouse Coopers. To learn more about The Private Sector, visit Investopedia. What are some of the big pros and cons of a company in the private sector?

What is the Public Sector?

The public sector includes a section of the economy that includes all levels of government and government-controlled ventures. It does not include voluntary organizations, private companies, and households. Some examples of companies that are in the Public Sector include the police, military, public roads, public transit, and public education.

What is the Voluntary Sector?

The voluntary sector, also known as the independent sector or civic sector, is where social activity and initiatives are centered. These are non-governmental organizations, also known as non-profits. Within this sector, the heart work is done. Even though the work tends to be personal, those working within the financial areas of these companies must know about finance for nonprofits. Examples in this sector include:

- Charities:

- World Vision,

- American Red Cross,

- YWCA;

- Foundations:

- David Suzuki Foundation,

- Bill and Melinda Gates Foundation;

- Social Welfare Organizations:

- Human Rights Watch,

- Environmental Protection Agency (EPA);

- and Advocacy Groups:

- Privacy International,

- World Wildlife Fund.

Investment Opportunity

One of the critical fundamentals in finance is investing. Now is not just the perfect time for you to invest in your career in finance; it is the time. If you are particularly curious about the idea of corporate finance, consider taking this Corporate Finance course from Udemy to see if this is a road you would like to pursue.

Foundations of Finance

One fan-favorite song from the Broadway musical Cabaret is “Money.” This song talks about how money makes the world go round no matter the country you are in. Check out this article from Investopedia on the origins of finance. Was there anything that surprised you? How do you feel about the idea that money is invisible?

Eugene F. Fama is a 2013 Nobel laureate in economic sciences, and he is widely recognized as the “father of modern finance.” Fama’s research is well-known in academia and investment communities. His research is focused on the efficient markets hypothesis. Fama’s research focuses on the relationship between risk and expected return and its implications for portfolio management. To read more on the godfather of modern finance, click here.

What is Finance?

Now that we have some historical context to this subject let’s define it, shall we? What is Finance, and what does it entail? Finance is the study of money and how people and businesses raise capital and evaluate their investments. In our research, we find that many scholars in finance have the same ideals and philosophies worded differently. So here, we will keep it simple and to the point and allow you to investigate the foundations and principles of finance. We have whittled it down into six major key points.

- Currency has a scope of time – ever heard of the saying time is money? This is practically the same idea. No matter the line item, there will be a price and a time associated with it. Say, for instance, your salary. You could be paid hourly for your work, or you might receive a yearly salary. Also, remember that there are opportunity costs at hand as well. An opportunity cost is when there is a loss of potential gain from alternatives when one alternative is chosen.

- Risk Return Trade-Off – Here, many want to make sure they enter the deal with low risk in hopes of a high reward.

- Diversification of Investments can reduce risk – the more your hands are in other posts, the better.

- Financial markets are efficient in pricing financial securities – investors look at every detail when they decide to take on risk from its inception to where it is and forecast for the future financially. They keep tabs on this information. While trends change in the business, this is still a litmus test for them.

- Manager & stockholder objectives may differ – The manager is working in the company’s best interest, while the stockholder wants stocks to sell at a maximum rate.

- Reputations matter – In the fast-paced world of finance and investments, you only have one shot sometimes, and ethical behavior is vital.

Understanding what finance entails is a pretty large project to tackle. In fact, it is impossible to understand every facet. Because our world is constantly advancing and changing, the world of finance is constantly growing and changing. One way to stay on top of the sector is to stay in touch with current events. One great way to do that is with podcasts. For example, one giant in the world of finance is Robert Kiyosaki, author of Rich Dad, Poor Dad. Check out his podcast, the Rich Dad Radio Show. Pick a few podcasts to listen to and come back for more another day.

Investment Opportunity

Coursehero has a free course for those who want to key in on fundamental principles and practices in finance. Another great source is Foundation of Finance 9th Edition by Arthur Keown, John Martin, and J. Petty.

Changes in Finance

On any given day, people can walk into local Walmart stores and find a cleaning machine going up and down the many aisles sweeping and mopping the floor. Now this machine does not have a technician; it is a robot. Some banks have done away with teller booths and now have special ATMs that serve as the teller where you can check your account, make deposits, and pull money.

So we say this because, with time, there comes about a change in every industry. Because time is money, executives have partnered with scientists to customize an experience that will cut back on physical labor to increase their bottom line.

Popular YouTuber/Finance guru Chris Haroun mentioned a forecasted positioning of Artificial Intelligence within a stock analysis. As the industry starts to shift, you need to ensure that you are ahead of the curve and prepared for the many changes that are set to hit the finance industry, especially during the pandemic and after.

The Boston University Alumni Association held a webinar presented by Thierry Guedj, Ph.D.. The webinar centered on finance careers and understanding how current social, technological, and governance trends are revolutionizing the world of finance. Other topics on the agenda include impact investing, AI, big data, bitcoin, blockchain, data security, user experience, and more.

Once you finish the webinar, listen to this podcast titled The Future of Finance with Laura Shin on the Mission Daily. If the finance sector is in your future, then bitcoin and cryptocurrency are in your future. Once you are done with the webinar and podcast, write out some questions you have about financial technology or fintech for short. Consider checking out an online course, like this Cryptocurrency and Blockchain course from the University of Pennsylvania. Shoring up your knowledge in this area of finance will be important for years to come.

Investment Opportunity

Cornell University offers an eight-week online program with four classes: Cryptocurrency and Ledgers, Cryptocurrency Essentials, Blockchain Fundamentals, and Applications in Blockchain Technologies. Also, a great book to read is The Future of Finance: The Impact of FinTech, AI, and Crypto on Financial Services 1st ed. 2019 Edition by Henri Arslanian and Fabrice Fischer.

Opportunities in Finance

As stated in the opening of this course, when we think about finance careers, we have this idea of someone crunching numbers behind a desk, but that has changed. There are more jobs out there other than the person who is doing your taxes or retirement investing. Read through this article by David Kochanek, titled Financial Career Options for Professionals. What careers stand out to you? Pick a few and do some investigation on what they entail and how you could possibly find yourself in positions within these careers.

Highest Paying Finance Jobs

Statistics show that from 2023 to 2033, there is a projected growth of 9% in jobs within the finance umbrella. Here’s a list of the highest-paying jobs in the finance world. Below we show the national average salaries of the highest-paying jobs within the field of finance:

- Investment banker: $408,000 per year

- Information technology auditor: $92,727 per year

- Compliance analyst: $92,000 per year

- Financial advisor: $76,556 per year

- Insurance advisor: $100,217 per year

- Financial analyst: $79,494 per year

- Senior accountant: $83,808 per year

- Hedge fund manager: $227,000 per year

- Financial Software Developer: $130,160 per year

- Private Equity Associate: $298,000 per year

- Chief Financial Officer: $156,100 per year

- Chief Compliance Officer: $75,670 per year

When researching finance careers, it is important to get information from the horse’s mouth, per se. Look through the podcast from the Association of Financial Professionals, called AFP Conversations. Executives and leaders in the finance industry spend time talking about current events, finance careers, and more.

Started From The Bottom

When I think of the world of finance, I am reminded of the song by the rapper Drake where he says in the lyrics that he started from the bottom and now he’s here. Professionals must keep things in perspective and know that entry-level jobs in this field have an excellent salary, but you have to have years of experience and outstanding education to see some of the numbers listed above. While looking at these numbers, it can be an incentive to get your finance degree, like an MBA in Finance; remember, hard work comes with a hefty salary!

You must set goals and write a plan for your career. If you can see it, then you can achieve it. Check out this Career Planning Process set up by Indeed. While working through this course, you are in step two, career research. Have you completed step one? What step is next for you?

A career in finance has shown to be very lucrative, but it comes with hard work, dedication to your education, and making lasting relationships. Remember that your networks will determine your net worth. You might be asking, where do I fit in? Here’s a webinar, by Wilfrid Laurier University, where career professionals in finance talk about their journey, current jobs, and how a degree in finance helped them achieve success. Remember, the more you know, the more you will grow.

“The most difficult thing is the decision to act; the rest is merely tenacity.” – Amelia Earhart.

Investment Opportunity

Now we can’t get sidetracked by looking at salaries and numbers. Let that be the fuel to push you to work harder! We must think about leveling up. The more certifications and certificates you have, the more appealing you are to your employer. Take a look at this online course in Finance through Cornell University. Having an Ivy League Certification along with your MBA sounds good. Let’s level up!

Finance Talent Stack

To be a master in this field, you must have diverse knowledge and a toolbox filled with the material to succeed. So what does it look like to have a full Finance Stack?

The first step is to obtain a bachelor’s degree in finance at an accredited university. Unlike accounting and real estate, you must have a bachelor’s to work in upper-level management and leadership in finance. If you are entirely new to the jargon in the industry, here’s an introductory online course through MIT Open Course.

Landing a job in the competitive arena of finance isn’t impossible, but highly competitive and takes a lot of work. This job market can be very cynical. It would help if you took every opportunity to educate yourself in the field and intern, make lasting relationships, and build a strong network. Also, you might want to look into taking the CFA (Credentialed Financial Analyst Exam). Here’s a great video on approaching strategy for the CFA. The CFA is a three-part exam that tests investment tools, valuing assets, portfolio management, and wealth planning.

Another exam to prepare for is the SIE (Securities Industry Essentials Exam). The SIE tests basic information, including products, risks, the structure & function of the securities industry and its regulatory agencies, and knowledge of regulated and prohibited practices. According to Investopedia, here are a few key takeaways you might want to put in your talent stack.

- You don’t need an MBA to work in finance, but the field is highly competitive, especially at the entry-level.

- Internships offer experience, exposure, and a try-out for a full-time gig.

- If you qualify, take advantage of the diversity-oriented programs many firms use to recruit women, minorities, veterans, the disabled, and LGBTQI-community members.

- If you don’t want to major in a finance-related field, minor in one—or at least take a course or two.

- Read financial publications and literature regularly; learn the basics.

- Consider sitting for financial industry credentialing exams, like the CFA or the SIE.

If you are thinking about leveling up, then I am sure you have a few questions about the CFA and the SIE exams. Here’s the answer to your questions on the CFA, and who should take the SIE exam?

How You Start Is How You Finish

If you have made it this far in the Finance Stack course, that means you are dedicated, and you are ready to take it to the next level with your career in finance. How you start the race is how you will finish the race, and having this competitive edge will prepare you for the finance world.

Everyone needs a mentor or someone who will guide them through uncharted waters. Take the time to research people who have walked the path that you are going down. Follow them on their social media and start engaging with them.

More than likely, they will respond. We all say reach one, teach one, and many successful people find it honorable to mentor a student. It would help if you had an accountability partner as well. Sometimes we get in our own way, and we need that outside set of eyes and voice to knock us back into reality.

Investment Opportunity

There are so many areas in the finance realm, and you have to decide what place you would like to investigate and gain knowledge on. Here are a few certification classes through Coursera that might lead you on your way to success. While these courses are available for free, for a small fee, students can receive a certificate that looks great on any resume.

If you are interested in the CFA Exam, here’s the CFA Program Curriculum 2020 Level II Volumes 1-6 Box Set (CFA Curriculum 2020) 1st Edition. Remember to start strong and level up!

The great Greek playwright Sophocles once wrote that “wisdom outweighs any wealth,” which holds true with life across the board. In this field of work, your knowledge and creative outlook are vital pieces to the puzzle. A diverse resume and exposure to foreign markets give you a heads-up on your competitors in the ever-changing world of finance.

Is there a demand for employees in the field of Finance?

Yes, there is a demand for employees in the field of finance. The finance industry is rapidly growing, and many financial institutions are looking for qualified and experienced professionals to fill positions in areas such as banking, investments, insurance, and accounting. In addition, finance professionals are in demand in other industries, such as technology, healthcare, and retail, to provide financial advice and analysis.

To Wrap Things Up

- This finishes our free online course to help you develop your finance stack. We hope it gives you a great foundation to build upon!

- Financial Management is great for those who are focused on all things finance-related. An MBA stack is great if you are looking for a job promotion in leadership or simply effective financial management.

- Financial Managers are responsible for overseeing financial planning, cash management, analyzing financial data, financial risk management, compiling financial statements, and managing a financial management system. Other financial management procedures include staying current on financial resources, portfolio management, business operations, as well as a company’s financial health and capital structure.

- Financial Management professionals enjoy a profitable salary. With the proper skills, you can make between $156,100 and $239,200 annually as a Financial Manager, according to the BLS.

Written by: Tammie Cagle

Before you go, see the following:

- Top MBA in Finance Career Paths – Job & Salary Information

- The Best MBA in Finance Degree Programs

- The Cheapest Online MBA in Finance Schools